A story in a national news source earlier this month about freezing your child’s credit file to preempt ID thieves prompted many readers to erroneously conclude that all states allow this as of 2016. The truth is that some states let parents create a file for their child and then freeze it, while many states have no laws on the matter. Here’s a short primer on the current situation, with the availability of credit freezes (a.k.a “security freeze”) for minors by state and by credit bureau.

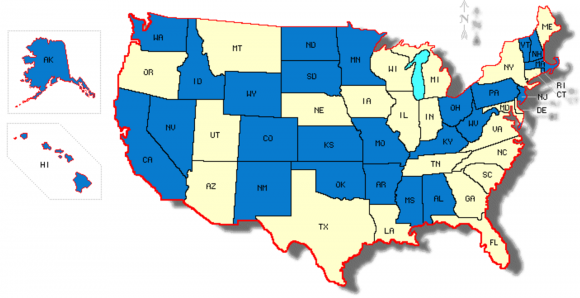

The lighter-colored states have laws permitting parents and/or guardians to place a freeze or flag on a dependent’s credit file.

A child’s Social Security number can be used by identity thieves to apply for government benefits, open bank and credit card accounts, apply for a loan or utility service, or rent a place to live. Why would ID thieves wish to assume a child’s identity? Because that child is (likely) a clean slate, which translates to plenty of available credit down the road. In addition, minors generally aren’t in the habit of checking their credit reports or even the existence of one, and most parents don’t find out about the crime until the child approaches the age of 18 (or well after).

A 2012 report on child identity theft from the Carnegie Mellon University CyLab delves into the problem of identity thieves targeting children for unused Social Security numbers. The study looked at identity theft protection scans done on some 40,000 children, and found that roughly 10 percent of them were victims of ID theft.

The Protect Children from Identity Theft Act, introduced in the House of Representatives in March 2015, would give parents and guardians the ability to create a protected, frozen credit file for their children. However, GovTrack currently gives the bill a two percent chance of passage in this Congress.

So for now, there is no federal law for minors regarding credit freezes. This has left it up to the states to establish their own policies.

Credit bureau Equifax offers a free service that will allow parents to create a credit report for a minor and freeze it regardless of the state requirement. The minor also does not have to be a victim of identity theft. Equifax has more information on this offering here.

Experian told me that company policy is not to create a file for a minor upon request unless mandated by state law. “However, if a file exists for the minor we will provide a copy free to the parent or legal guardian and will freeze it,” said Experian spokesperson Susan Henson.

Henson added that depending on state law, there may be a fee ranging from $3 to $10 associated with the minor’s freeze. However, if the minor is a victim of identity theft and the applicant submits a copy of a valid police or incident report or complaint with a law enforcement agency or the Department of Motor Vehicles (DMV), the fee will be waived.

Trans Union has a form on its site that lets parents and guardians check for the presence of a credit file on their dependents. But it also only allows freezes in states that reserve that right for minors and their parents or guardians, and applicable fees may apply.

Innovis, often referred to as the fourth major consumer credit bureau, allows parents or guardians to place a freeze on their dependent’s file regardless of state laws.

According to Eva Casey Velasquez, president and CEO of the Identity Theft Resource Center, there are currently 23 states that have regulations that provide some kind of protective mechanism for parents and guardians when it comes to children’s credit reports.

“Some allow you to create and freeze a report, others allow for some kind of ‘flag’ on the Social Security number,” Velasquez said. “Kentucky has proposed legislation and it will go for a hearing, probably this month.”

Here’s a list of the states that have minor freeze laws on the books, and the status of pending state legislation from the National Conference of State Legislators (NCSL). That list currently includes Arizona, Connecticut, Delaware, Florida, Georgia, Illinois, Indiana, Iowa, Louisiana, Maine, Maryland, Michigan, Montana, Nebraska, New York, North Carolina, Oregon, South Carolina, Tennessee, Texas, Utah, Virginia and Wisconsin. These states are reflected in the map above as the lighter-colored states.

Many of these states will only allow parents or guardians to request a freeze if the child is 16 or younger. Others allow 18 years of age or younger, and some — like New York — are debating legislation to increase the age from 16 to 18.

According to the U.S. Federal Trade Commission (FTC), several signs can tip you off that someone is misusing your child’s personal information to commit fraud. For example, you or your child might:

-be turned down for government benefits because the benefits are being paid to another account using your child’s Social Security number

-get a notice from the IRS saying the child didn’t pay income taxes, or that the child’s Social Security number was used on another tax return

-get collection calls or bills for products or services you didn’t receive

The FTC has published a comprehensive set of resources that parents and guardians can use to check for the presence of a credit file on their child or dependent, including a checklist of what to do next if a file is found.

Readers have asked whether signing kids up for identity monitoring services might be a better solution than a freeze. As I explain in How I Learned to Stop Worrying and Embrace the Security Freeze, identity monitoring services are great for helping to recover from identity theft, but they are not so effective at blocking thieves from creating new accounts. The most you can hope for in that regard is that the service will alert you when a new account is created.

Some fans of my series explaining why I recommend that all adults place a freeze on their credit files have commented that one reason they like the freeze is that they believe it stops the credit bureaus from making tons of money tracking their financial histories and selling that data to other companies. Let me make this abundantly clear: Freezing your credit will not stop the bureaus from splicing, dicing and selling your financial history to third parties; it just stops new credit accounts from being opened in your name.

Incidentally, it appears many more consumers are starting to get the message about the efficacy of and/or need for security freezes. Bob Sullivan, an independent investigative reporter and editor of BobSullivan.net, recently polled the major credit bureaus and found a considerable uptick in new applications for security freezes in 2015. According to data Sullivan obtained from Credit.com, between 2011 to 2014 freeze users ranged from 130,000 to 160,000 annually. During that same period, about 600,000 consumers requested initial fraud alerts be placed on their credit files, Experian said.

“But that might have changed in 2015,” Sullivan wrote. “In February 2015 alone — the same month as the high-profile data leak at health insurer Anthem — nearly 160,000 consumers asked Experian for a credit freeze. Through October, the yearly total was 434,000, meaning about triple the consumers used freezes in 2015 than 2014.”

Source: Krebs